Owning your own house can provide you with security, long-term financial stability and the opportunity to really make your house a home for you and your family. A few years ago, saving for a mortgage was a challenge but not entirely out of reach for the majority of the population, but in recent years, all of that has changed.

House prices have skyrocketed, making deposits and the amount you need to borrow from the bank much higher. The dream of buying your own home is even further out of reach now than ever before, with only 27% of young people owning their own property compared to 65% of young people just twenty years ago.

The deposit is not the only expense that buyers need to consider, with additional costs such as insurance and tax also increasing. All of this can get even more complicated if you are one of the millions of self-employed individuals in the UK. The self-employed workforce can often struggle to get approved for a mortgage, even when they are earning a decent wage and have secured a large deposit.

The issue is that lenders like to have the assurance that the mortgage can be paid off, and employment and contracts provide this, whereas a self-employed individual has no guaranteed income. Despite this, it is still possible for freelancers and self-employed workers to secure a mortgage; it just might take a little more effort.

What do I need to get a mortgage?

Self-employed workers will need to be able to prove their income to a lender or bank when they apply for a mortgage. The norm is to provide at least two years’ of accounts or tax returns, but the more you can show the better. To apply for a mortgage when you are self-employed, you will need:

Two years accounts or tax returns

Lenders will calculate how much they can lend you by looking at your average business profit or SA302 income over the last few years.

An Accountant

Generally, it is preferred if borrowers have employed an accountant to prepare their accounts, and some lenders will go as far as to require the accountant is certified or chartered. They may also request your accountants details so that they can verify any income requirements with them directly.

A track record of regular work

Don’t worry too much if you do not have two years’ accounts available; some mortgage lenders will consider your application without two years of reports. If you can provide a proven track record of regular work or evidence of substantial contracts, employment or projects lined up for the future, then you may not need to show a trail of accounts.

A substantial deposit

The same as any borrower, your chances of being accepted for a mortgage are hugely increased if you have a decent deposit available. Often the more significant the deposit and when age is on your side, you will be more likely to receive a mortgage offer. The greater the deposit you can raise the less of a risk you become to the lender.

A positive credit history

A clean credit history will boost your chance of your getting a mortgage. Lenders will not just credit check you; they will also run checks on your business and business address. Make sure to sort out any unpaid or late debts and look over your personal and business’s credit report yourself to ensure there are no errors before applying for a mortgage.

Do I need a mortgage broker?

A mortgage broker will help you to fully understand the mortgage application process and help you to find the best deal for your individual situation. It is not a requirement to have a mortgage broker when applying for a self-employed mortgage, but it is a good idea to get some advice and guidance from a professional.

A broker will be able to help you collate everything you need to apply for a mortgage and give you some realistic options to look at. Most mortgage brokers will know which lenders are prepared to lend to self-employed workers and which will offer you the best rate.

Does my business set-up affect my mortgage options?

When you set up your business, you will have had three main structures to choose from, and the one you opt for will have an impact on how lenders view your income when it comes to applying for a mortgage.

Sole trader

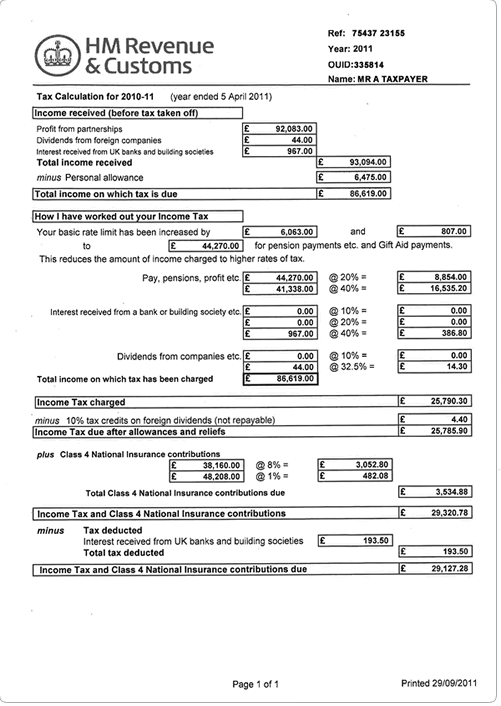

Keeping records and accounts is simple and straightforward for sole traders, and generally all of the profits made are kept. It is these profits that lenders will assess when you apply for a mortgage. If you do your tax by self-assessment and HMRC calculate it, then it is most likely that you will have a SA302 form which includes details on the total income received and total tax due. Mortgage lenders could ask to see this form along with your accounts, so make sure you have it handy when applying.

The SA302 document from HMRC will be required to show proof of income

Limited company

If you set up a limited company, then it means all your business assets are separate from your personal affairs. Limited companies will also have at least one director. Directors usually pay themselves a basic salary as well as dividend payments, and it is essential to ensure the lender is looking at both of these as income when assessing your mortgage affordability. They will take both your salary (earned income) and dividends into consideration as part of the income calculation.

Partnership

If you have gone into business with someone else, chances are you set up a partnership. When applying for a mortgage, lenders will look at each business partner’s share of the profit. Ensure you have accounts to show exactly how much money you have made so the lender can see your annual income easily.

What mortgage options do I have?

Technically, self-employed borrowers have access to all of the same mortgage products as everybody else. The current best mortgage deals on the market can be found online in mortgage rates tables. The main difference that you will have, compared to an employed borrower, is that you will need to be able to prove you have the necessary income to make the repayments.

This is where it can be a struggle for a self-employed individual to secure a mortgage, as you will need to provide at least two (sometimes three) years’ worth of company accounts, SA302s and tax returns. Some lenders will also require you to provide evidence of work you have secured for the future, to prove that your income will be maintained.

If you already have a home loan and are looking to re-mortgage, whether it is to move home or get a better deal. Your current lender will likely be a bit more sympathetic to your situation, even more so if you have a positive history of making repayments in a timely manner.

How much can I borrow?

The amount you can borrow will depend on the lender. However as a guide you could expect to be able to borrow between 4-5 times your verified income subject to affordability checks. This would be both earned income (salary) and dividend payments. As mortgage applications are more complex for self employed applicants it would advised to use a broker who can place your application with the most suitable lender. If you are a buy to let landlord for example some lenders will not consider income from your investment properties as part of the income calculation.

Which mortgage lender should I approach?

There is a selection of lenders out there who are specialists in designing mortgages for the self-employed, which could be worth researching further. However, many general mortgage lenders often lend to the self-employed too, so there is no requirement to choose a specialist.

You will have full access to a considerable range of fixed and variable mortgages, so be sure to shop around, some lenders will be more comfortable with self-employed borrowers than others, and so will be more likely to offer a better deal.

What if I am recently self-employed?

Most lenders will require at least two years of accounts when assessing a mortgage for a self-employed borrower. However, if you cannot provide this because you have only recently started out on your own, don’t lose hope. Some specialist lenders will consider applicants who only have one year of accounts.

In this kind of situation, it all comes down to the specific individuals’ circumstances. If you are recently self-employed but have a long history of employment within the same industry, then some lenders will consider your application even with less than two years accounts. However, if possible, waiting a while to improve your finances and increase your deposit amount can help you to secure a better deal.

What else can I do to improve my chances of being approved?

>> FREE Mortgage Brokerage For Self Employed Applicants

>> FREE Mortgage Brokerage For Self Employed Applicants

Prepare in advance

Good preparation will help to ensure you get the mortgage you want and be able to borrow the amount you need. It’s advisable to speak with a mortgage broker as early as possible to get an idea of what options you have. Ensure your self assessment and business accounts are up to date and in good order. Check your income levels are suffient enough to meet your borrowing needs. You may decide that you need to take larger dividends or larger profits from your business prior to a mortgage application in order to qualify for a larger mortgage, therefore you will need to plan for this at least 12 months in advance so the higher income level shows on your SA302 self assessment calculations. Consider that lenders will generally take an average of your last 2 years income figures to calculate your income and therefore how much you can borrow.

Save as much deposit as you can

The bigger deposit you can save, the less you need to borrow. If you are a first-time buyer, consider buying somewhere smaller than initially planned, or maybe somewhere a bit further out of town or in a cheaper neighbourhood. This gives you the chance to buy a home that is slightly more affordable, and spend a few years saving up so that you are in a better position to sell and move up the housing ladder – and into your dream home – a couple of years down the line.

Consider shared ownership

Shared ownership can be a fantastic option for self-employed workers; you may be able to purchase the first 25% outright and avoid needing a mortgage altogether. You would then be renting the rest while also saving for a deposit to be able to buy the rest. It is common to be able to buy in 10% shares, which means manageable deposits and low mortgages.

Wait a bit longer

If you are under no pressure to buy and move immediately, waiting a bit longer can be beneficial. As most lenders want two years’ worth of accounts and tax returns from self-employed borrowers, it might be worth waiting until your business is turning over a decent profit.

Claim less business expenses

As a business owner, it is normal to want to claim as many tax deductibles as possible. This may be cutting your tax bill and saving you a significant amount of money, but not claiming or reducing the amount of expenses will actually raise the profitability of the business and your income on your SA302 earnings. You will pay more in taxes but could improve your chances of getting a mortgage with a higher verified income.

Ask for some help

If you are in a position to ask someone close to you for a loan to help with a deposit, that can be a real advantage. If that is not an option, then look into a guarantor mortgage. If you have someone willing to help you out, who owns their own home and is in employment, they can sign as a guarantor. In general, your guarantors will have to stay on the agreement until you have paid off a pre-agreed amount, and if you fail to make the repayments, your guarantor will be responsible. If you do go down this route, be sure to make all your payments on time, that way your guarantor will not be at all affected. This will protect their finances as well as your relationship with the guarantor.

Leave your name off the mortgage

If you are buying as a couple, it might be worth taking out a mortgage in only your partner’s name, instead of a joint application. If they have stable full-time employment, a substantial income and a clean credit score, they might be able to get a better mortgage as a single applicant than what you can get together. You can still have both your names on the deeds to the house, even if just one of your names is on the mortgage.

Work on your credit score

If you have a poor credit score, then whether you are self-employed or not, you will struggle to get approved for a mortgage. Firstly, check your credit score to see where you stand. If it is not quite up to scratch, then do everything you can to improve it. Register on the electoral roll, reduce any outstanding credit applications, pay off your debts and make sure you pay all your bills in a timely manner.

Second charge mortgages

If you already have a mortgage and require further borrowing via a second mortgage or second charge loan then the application process and income checks are still very much the same for the self employed. Most second charge lenders can provide loans up to 85% loan to value to carry out home improvements, debt consolidation and any other legal reason. Some lenders will grant loans up to 95% LTV but you will expect to pay far higher interest rates on those products..

Where do I start?

Now you have all the information about getting a mortgage when you are self-employed, you can start to plan your next steps. The best place to start is to work out what you can afford; how much can you afford to pay off every month? What kind of deposit do you have in the bank? Once you have worked these out, you can start shopping around for a mortgage and discussing your options with a mortgage broker.